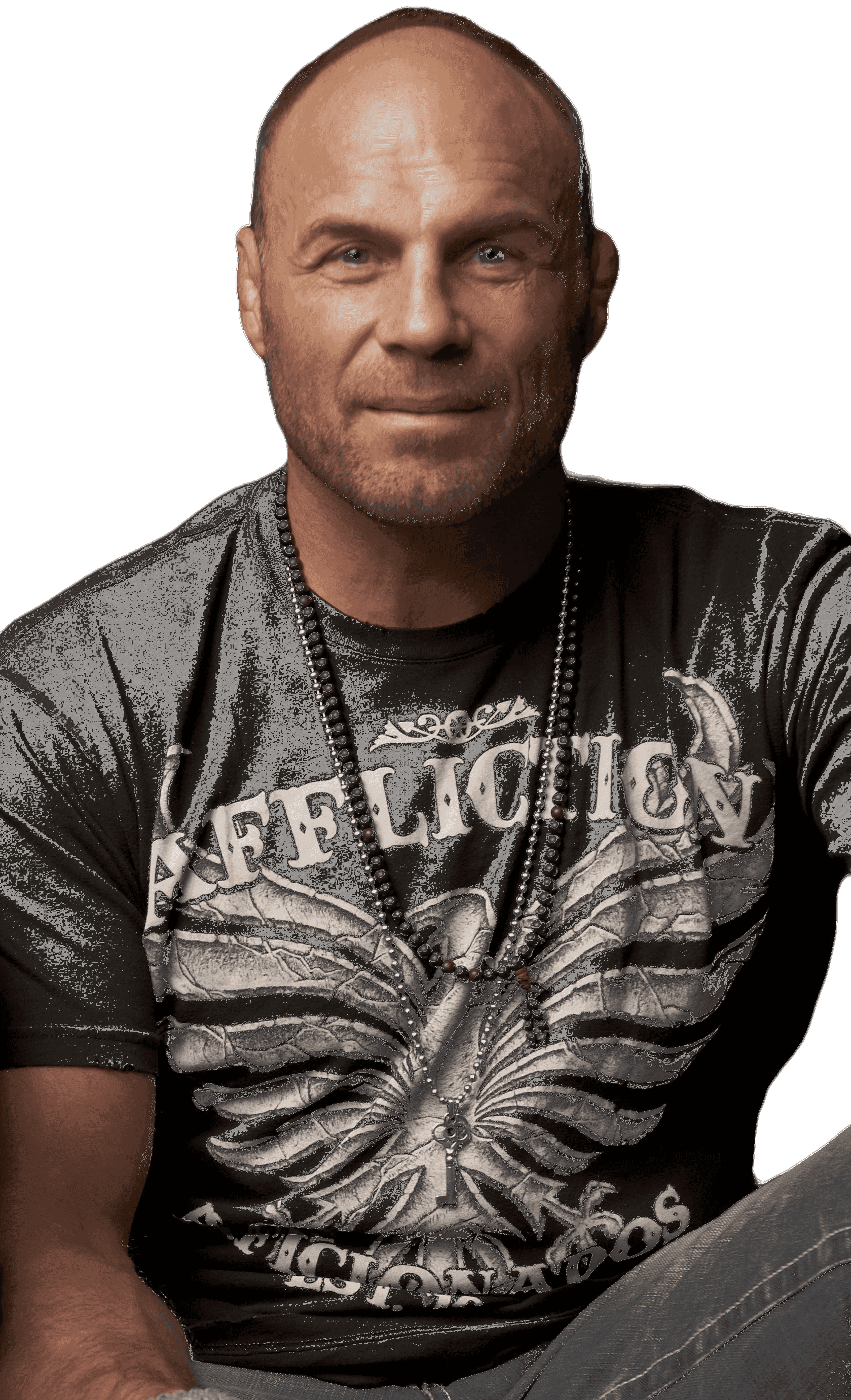

“If you are buying physical gold and silver, it pays to shop with trustworthy dealers and Metalsmart helps consumers do that.”

- Randy Couture

Blog

Don't Trust Gold Dealers Who Push Numismatic Coins

Trustworthy Gold Dealers Won't Push You to Expensive Products

Are you considering investing in gold or silver? If so, you should be aware of the dangers of buying numismatic coins from gold dealers. Numismatic coins are “rare” coins that are collected for their historical or artistic value, but they are often overpriced and illiquid. In this article, we discuss the difference between bullion and numismatic coins, why gold dealers push numismatics so hard, how to spot a shady gold dealer, and where to find a trustworthy gold dealer.

Know the difference between bullion and numismatics

Before you can understand the dangers of buying numismatic coins from gold dealers, it's important to understand the difference between bullion and numismatic coins. Bullion coins are minted from precious metals, such as gold, silver, platinum, and palladium, and are primarily used for investment purposes. They are typically sold at or near the spot price of the metal they are made from. Bullion coins have little to no numismatic (collectible) value.

Numismatic coins, on the other hand, are touted as rare (and often are not) coins that are collected for their historical or artistic value. They can be much older than bullion coins and may have unique features, such as special engravings or mint marks. Numismatic coins can be very expensive, and their value is often determined by their rarity and condition. Many dealers offer more recent numismatic coins, which are often not very rare and still charge high premiums for these.

Why do gold dealers push numismatics so hard?

Gold dealers push numismatic coins so hard because they can charge higher premiums (i.e., markups) on them than on bullion coins. Numismatics are often overpriced compared to their actual gold content, and dealers may use high-pressure sales tactics to convince uninformed buyers that they are a good investment.

While numismatic coins may be a good choice for some people, or a complement to their precious metals holdings, it is important to do your research before buying them. You should only buy numismatic coins if you are knowledgeable about them and if you are comfortable with the risks involved.

Here are some of the reasons why you should be wary of gold dealers who push numismatics:

Numismatic coins are often overpriced. The value of a numismatic coin is sometimes determined by its rarity and condition. However, many coins are not truly rare, and dealers may charge a markup that is 3 times or more than that of a bullion bar.

Numismatic coins are less liquid than bullion. It can be difficult to sell numismatic coins near their offer price because their dealer bid-offer spread can be 4 times as large as bars. This means that you may not be able to get as much money when you sell as you think.

Gold dealers may use high-pressure sales tactics. Gold dealers may use high-pressure sales tactics to convince you to buy numismatic coins. They may tell you that numismatic coins are a good investment, or that they are a rare opportunity.

If you are considering buying numismatic coins, it is important to do your research and to be wary of gold dealers who push them too hard. You should only buy numismatic coins if you are knowledgeable about them and if you are comfortable with the large premium and liquidity risks involved. Avoid dealers who push you into buying something you don’t fully understand. Ask them why they are recommending these products and compare the price per ounce that you will pay against the price per ounce of bullion products.

Get your free plan and save money on gold and silver today

Get your free plan and save money on gold and silver today