“If you are buying physical gold and silver, it pays to shop with trustworthy dealers and Metalsmart helps consumers do that.”

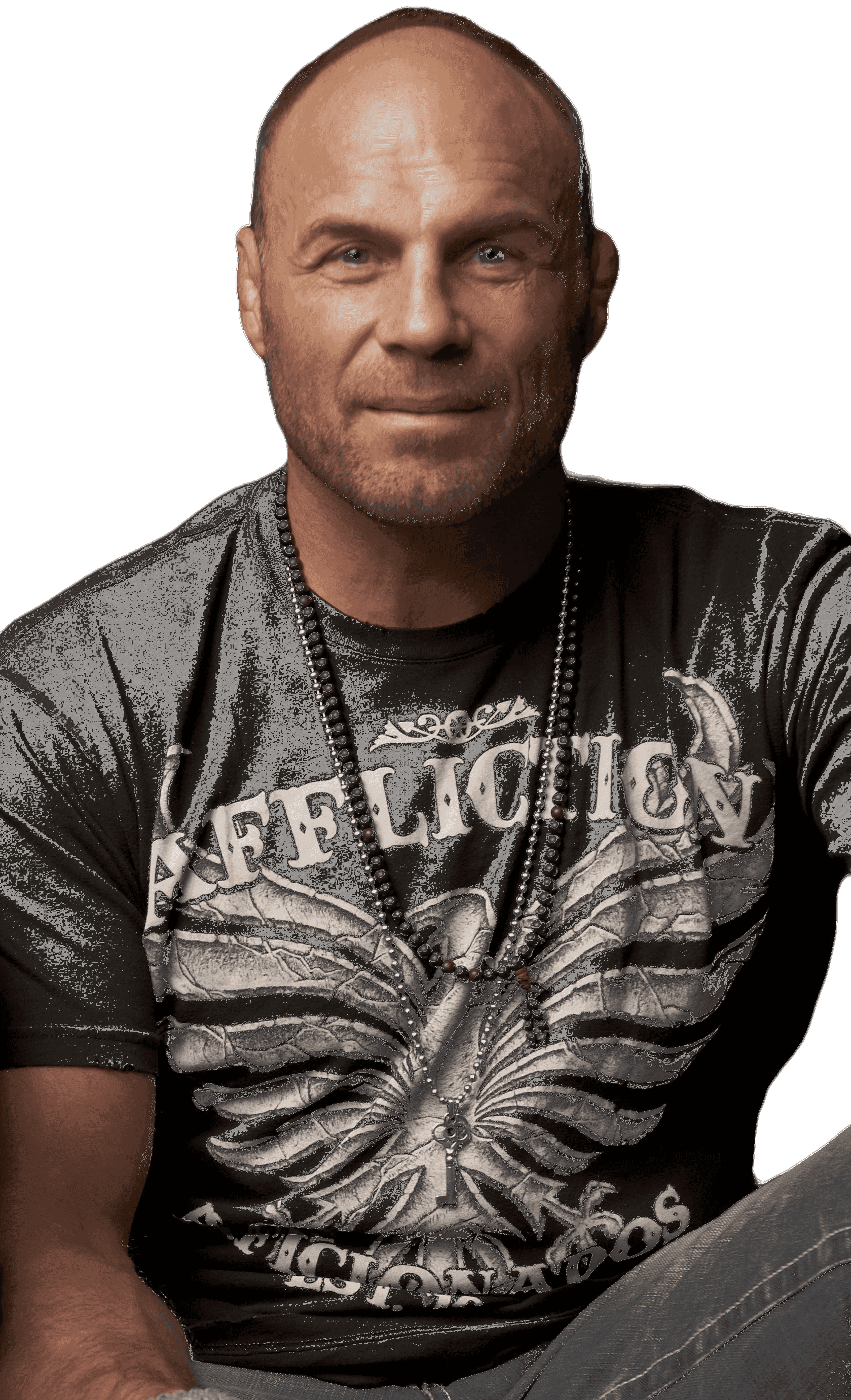

- Randy Couture

Blog

3 Reasons to Consider a Gold IRA for Your Retirement Portfolio

Diversify your retirement assets and protect your wealth

Are you looking for a way to protect and grow your retirement savings? A gold IRA may be the perfect investment for you. Gold has historically outperformed other investments during times of inflation and economic uncertainty, making it a valuable holding in any retirement portfolio. In this article, we will explain the three main reasons you should consider a gold IRA for your retirement portfolio: preserving your wealth, tax benefits, and diversification.

Preserving your wealth with a Gold IRA

Gold has long been considered a safe-haven asset, a store of value that retains its worth even when other investments falter. This is because gold's value tends to rise when the dollar weakens, acting as a hedge against inflation and economic downturns. A gold IRA can provide a sense of security because gold has historically held its value during tumultuous times.

Gold has consistently demonstrated its ability to maintain its value, making it an ideal asset to preserve wealth over the long term. By opening a gold IRA, investors can safeguard their retirement savings from the erosive effects of inflation and economic downturns and ensure that their wealth remains intact, providing peace of mind for their golden years.

Furthermore, owning physical gold in an IRA means that investors have direct ownership and control over their wealth. Unlike paper assets such as stocks and bonds, which are subject to the whims of financial institutions, physical gold held in an IRA is a tangible asset that investors can hold and possess. Gold IRAs provide an added layer of security and control, ensuring that investors are not solely reliant on the stability of financial markets to preserve their wealth.

Tax benefits of a Gold IRA

Gold IRAs offer several tax benefits that make them an attractive investment option for retirement savings. One significant advantage is the tax-deferred growth of investments. Contributions to a gold IRA grow tax-free, meaning investors do not pay taxes on any appreciation in the value of their gold until they withdraw it from the account. This tax deferral allows investors to accumulate wealth more quickly and efficiently.

Another tax benefit of gold IRAs is the potential for favorable tax treatment upon withdrawal. While distributions from a gold IRA are taxed as ordinary income, the tax rate may be lower than the tax rate on capital gains, especially for individuals in lower tax brackets. This tax advantage can result in significant savings for retirees who are mindful of their tax liability.

Gold IRAs can also be used to make tax-free transfers or rollovers from other IRAs or employer-sponsored retirement plans, many of which do not offer physical gold as an investment choice.

Overall, the tax benefits associated with gold IRAs make them a compelling investment option for individuals looking to save for retirement. The potential for tax-deferred growth, favorable tax treatment upon withdrawal, and flexibility in withdrawal options make gold IRAs a valuable tool for building a secure financial future.

Diversify your portfolio with a Gold IRA

Diversification is a key strategy to manage risk and enhance returns over the long term. Gold can play a valuable role in portfolio diversification due to its unique characteristics and historical performance.

Unlike traditional investments such as stocks and bonds, gold is not subject to the same market forces and economic cycles. The price of gold tends to move independently of other assets, making it an effective hedge against market volatility. When stocks and bonds experience downturns, gold often holds its value, providing stability to a diversified portfolio.

Gold's diversification benefits are particularly evident during times of economic uncertainty and geopolitical tensions. It has a history of performing well during such periods, acting as a safe haven for investors. Gold's value tends to appreciate when traditional investments decline, offering a counterbalance to potential losses in other asset classes.

By allocating a portion of your retirement portfolio to gold, you can help reduce your overall risk and improve the risk-return profile of your investments. The stability and diversification benefits of gold can enhance your chances of achieving your long-term financial goals, even in challenging market conditions.

Get your free plan and save money on gold and silver today

Get your free plan and save money on gold and silver today